The global chief of Polestar insists the Swedish-Chinese EV specialist has a viable future despite a billion dollar loss and media headlines suggesting it could go bankrupt.

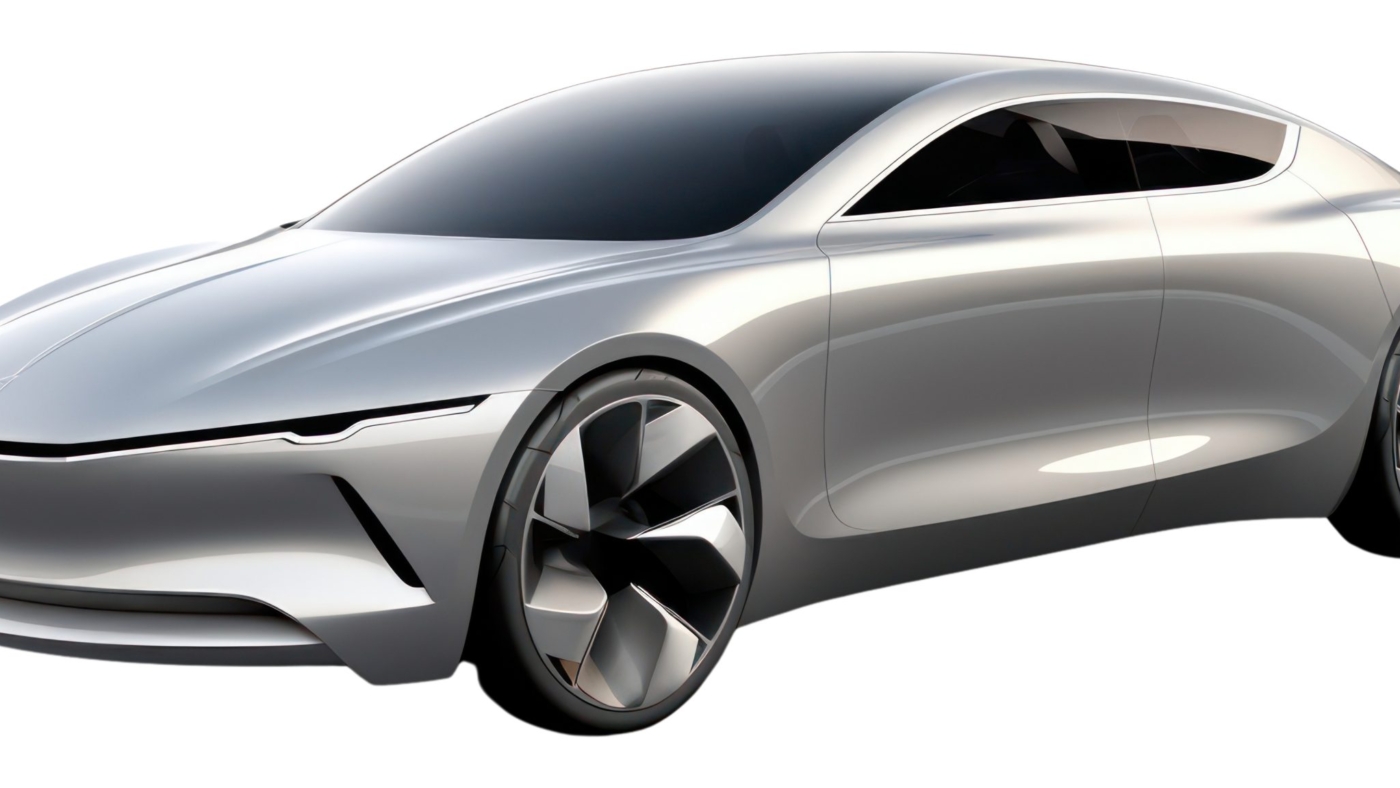

The disastrous quarter two 2025 loss of $US1.03 billion ($1.56 billion) was revealed in the days leading up to the Munich motor show where the new flagship Polestar 5 luxury saloon (pictured top) was launched.

That meant CEO Michael Lohscheller spent plenty of time in Munich trying to paint a positive picture of Polestar’s future in the face of its dreadful financials, instead of eulogising the brand’s new Porsche Taycan fighter.

READ MORE: Polestar 5 debuts: Australian pricing, options and supercar performance confirmed for Audi e-tron, BMW i5 and Porsche Taycan luxury rival

READ MORE: 2026 Polestar 2 updated and new pricing detailed: For once, the best news is reserved for the cheapest model

READ MORE:Just how long range is the 2025 Polestar 3 Long Ranger? We drive Western Australia’s EV Highway to find out

“We have a clear going concern and we have support,” insisted Lohscheller.

“All operational indicators show in the right direction and we do the right things.”

Polestar’s gloomy accounts stem from both short- and long-term factors.

The pressing short-term issue is the huge Q2 loss primarily triggered by a $US739 million ($1.122 billion) impairment charge on the US-built version of the Polestar 3 SUV.

An impairment charge is a permanent reduction in an asset’s value and it’s been applied to the US-made 3 – which is also built in China, from where Australian supply emanates – because of tariffs and higher than expected production costs.

“That was very much driven by the US situation and that’s a one-time impact we had to book,” explained Lohscheller. “That’s why you get the headlines ‘hey the losses are big’.”

But the reality is Polestar has never made money since it was recast from an independent racing team to a luxury EV subsidiary of Volvo in 2017.

Are the tough times over? Polestar sales on the up in Australia as Polestar 4 makes an impact

Volvo sold down its share of Polestar in 2024 to avoid pouring in more of its own reserves. In the last four years Polestar’s share price has deflated from $US16 to an alarming $US1.03 this week.

Polestar has recently suspended any estimate of cash flow break-even timing after pushing it back from 2025 to January 2027.

It has also had to renegotiate debt covenants and relies on investment from Geely chief Li Shufu’s company PSD Investment, that has taken an increased stake in the business.

Recent media reporting has pointed out a disclosure in the H1 earnings report that states: “Uncertainty related to the execution of management’s liquidity and funding plan indicates the existence of a material uncertainty that may cast significant doubt upon Polestar’s ability to continue as a going concern.”

While that makes a frightening read, that statement has been published in every earnings report for the last four years because it is a required US statement, Polestar says.

Lohscheller was at pains to point out Polestar’s positives, although he spread his gaze to include financials for the first half of 2025 and not just Q2.

2028 Polestar 7 SUV previewed! EV maker gears up for the launch of its next best-seller and its next-gen EV tech

“Volume was up 51 per cent, revenue was up 56 per cent. For the first time in the history of Polestar we achieved a positive operating gross margin,” he said.

“Costs are coming down and EBITA (earnings before interest, taxes and amortisation) losses are also reducing.”

The German former Opel executive was installed at Polestar in place of Thomas Ingenlath in October 2024.

He has since switched Polestar from direct sales to a traditional dealer model, including in Australia. This has been achieved quickly by predominantly enlisting the global Volvo network.

“We want to be as close as possible to consumers,” said Lohscheller. “While the direct to consumer model is an option I personally believe to be close to customers, to give advice, to really offer service, to talk, to have different offers is the secret.

“I call this the renaissance of the dealers in a way. It seems that is working really well.”

Longer term, he has recast the product roll-out to prioritise the Polestar 7 compact SUV that will be its cheapest and biggest-selling model. It will be on-sale early 2028.

The 7 will be built on a shared Volvo platform in a new Volvo plant in Slovakia, thereby amortising development costs and EU tariffs on vehicles imported from Polestar’s Chinese factory.

“That makes a tonne of sense because the majority of our volume is in Europe and then we don’t have to ship the cars around the world,” explained Lohscheller.

Polestar Concept BST tackles Goodwood on a typical English summer day

“The tariff problem is also not there because you produce locally in Europe. This will make life much easier.

“We also want to go into segments that are bigger, so compact SUV segment is quite big.”

At the same time Lohscheller has pushed back the introduction of the Polestar 6 sports car that would be high cost, low sales and expensive to develop as it is based on the same high-tech aluminium structure as the 5.

The British-based engineering division that developed the 5 and was in charge of the 6 has been reduced from a staff of 600 to 150 as a result of this postponement.

There is doubt 6 will ever be built, as Lohscheller refused to guarantee when it would be re-inserted in the future model roll-out.

“We have Polestar 6 and we want to do it. But guaranteed is a strong word, but that is our intention to do the Polestar 6,” he said.

If volume is critical it would also make sense the second-generation Polestar 2 is rolled out ahead of the 6.

Polestar CEO Michael Lohscheller.

In 2025, Polestar is enjoying a sales boost with the help of the Polestar 4 cross-over that launched in late 2024. The Polestar 3, while slow-selling, is also fresh in the market.

Around the globe sales have grown 51 per cent and in Australia 46 per cent.

“We feel our portfolio is very strong,” said Lohscheller. “The Polestar 2 is still very successful, Polestar 3 and 4 are super-fresh cars, now the Polestar 5 comes on top and we now have the benefit of all cars being available in the market.

“And at the same time we have set up the dealer network and that’s the way to go.”

The post “We do the right things”: Despite a horror billion dollar loss, Polestar boss talks up luxury EV maker’s future prospects appeared first on EV Central.

The global chief of Polestar insists the Swedish-Chinese EV specialist has a viable future despite a billion dollar loss and media headlines suggesting it could go bankrupt.

The disastrous quarter two 2025 loss of $US1.03 billion ($1.56 billion) was revealed in the days leading up to the Munich motor show where the new flagship Polestar 5 luxury saloon (pictured top) was launched.

That meant CEO Michael Lohscheller spent plenty of time in Munich trying to paint a positive picture of Polestar’s future in the face of its dreadful financials, instead of eulogising the brand’s new Porsche Taycan fighter.

READ MORE: Polestar 5 debuts: Australian pricing, options and supercar performance confirmed for Audi e-tron, BMW i5 and Porsche Taycan luxury rival

READ MORE: 2026 Polestar 2 updated and new pricing detailed: For once, the best news is reserved for the cheapest model

READ MORE:Just how long range is the 2025 Polestar 3 Long Ranger? We drive Western Australia’s EV Highway to find out

“We have a clear going concern and we have support,” insisted Lohscheller.

“All operational indicators show in the right direction and we do the right things.”

Polestar’s gloomy accounts stem from both short- and long-term factors.

The pressing short-term issue is the huge Q2 loss primarily triggered by a $US739 million ($1.122 billion) impairment charge on the US-built version of the Polestar 3 SUV.

An impairment charge is a permanent reduction in an asset’s value and it’s been applied to the US-made 3 – which is also built in China, from where Australian supply emanates – because of tariffs and higher than expected production costs.

“That was very much driven by the US situation and that’s a one-time impact we had to book,” explained Lohscheller. “That’s why you get the headlines ‘hey the losses are big’.”

But the reality is Polestar has never made money since it was recast from an independent racing team to a luxury EV subsidiary of Volvo in 2017.

Are the tough times over? Polestar sales on the up in Australia as Polestar 4 makes an impact[embedded content]

Volvo sold down its share of Polestar in 2024 to avoid pouring in more of its own reserves. In the last four years Polestar’s share price has deflated from $US16 to an alarming $US1.03 this week.

Polestar has recently suspended any estimate of cash flow break-even timing after pushing it back from 2025 to January 2027.

It has also had to renegotiate debt covenants and relies on investment from Geely chief Li Shufu’s company PSD Investment, that has taken an increased stake in the business.

Recent media reporting has pointed out a disclosure in the H1 earnings report that states: “Uncertainty related to the execution of management’s liquidity and funding plan indicates the existence of a material uncertainty that may cast significant doubt upon Polestar’s ability to continue as a going concern.”

While that makes a frightening read, that statement has been published in every earnings report for the last four years because it is a required US statement, Polestar says.

Lohscheller was at pains to point out Polestar’s positives, although he spread his gaze to include financials for the first half of 2025 and not just Q2.

2028 Polestar 7 SUV previewed! EV maker gears up for the launch of its next best-seller and its next-gen EV tech[embedded content]

“Volume was up 51 per cent, revenue was up 56 per cent. For the first time in the history of Polestar we achieved a positive operating gross margin,” he said.

“Costs are coming down and EBITA (earnings before interest, taxes and amortisation) losses are also reducing.”

The German former Opel executive was installed at Polestar in place of Thomas Ingenlath in October 2024.

He has since switched Polestar from direct sales to a traditional dealer model, including in Australia. This has been achieved quickly by predominantly enlisting the global Volvo network.

“We want to be as close as possible to consumers,” said Lohscheller. “While the direct to consumer model is an option I personally believe to be close to customers, to give advice, to really offer service, to talk, to have different offers is the secret.

“I call this the renaissance of the dealers in a way. It seems that is working really well.”

Longer term, he has recast the product roll-out to prioritise the Polestar 7 compact SUV that will be its cheapest and biggest-selling model. It will be on-sale early 2028.

The 7 will be built on a shared Volvo platform in a new Volvo plant in Slovakia, thereby amortising development costs and EU tariffs on vehicles imported from Polestar’s Chinese factory.

“That makes a tonne of sense because the majority of our volume is in Europe and then we don’t have to ship the cars around the world,” explained Lohscheller.

Polestar Concept BST tackles Goodwood on a typical English summer day

“The tariff problem is also not there because you produce locally in Europe. This will make life much easier.

“We also want to go into segments that are bigger, so compact SUV segment is quite big.”

At the same time Lohscheller has pushed back the introduction of the Polestar 6 sports car that would be high cost, low sales and expensive to develop as it is based on the same high-tech aluminium structure as the 5.

The British-based engineering division that developed the 5 and was in charge of the 6 has been reduced from a staff of 600 to 150 as a result of this postponement.

There is doubt 6 will ever be built, as Lohscheller refused to guarantee when it would be re-inserted in the future model roll-out.

“We have Polestar 6 and we want to do it. But guaranteed is a strong word, but that is our intention to do the Polestar 6,” he said.

If volume is critical it would also make sense the second-generation Polestar 2 is rolled out ahead of the 6.

Polestar CEO Michael Lohscheller.

In 2025, Polestar is enjoying a sales boost with the help of the Polestar 4 cross-over that launched in late 2024. The Polestar 3, while slow-selling, is also fresh in the market.

Around the globe sales have grown 51 per cent and in Australia 46 per cent.

“We feel our portfolio is very strong,” said Lohscheller. “The Polestar 2 is still very successful, Polestar 3 and 4 are super-fresh cars, now the Polestar 5 comes on top and we now have the benefit of all cars being available in the market.

“And at the same time we have set up the dealer network and that’s the way to go.”